Legislation requires that companies regularly download the data from their drivers' cards, store and archive it securely, and check for any infringements of driving times, breaks and rest periods. With our solutions for remote reading of tachographs and driver cards, you can easily and automatically fulfil these requirements.

Legislation requires that companies regularly download the data from their drivers' cards, store and archive it securely, and check for any infringements of driving times, breaks and rest periods. With our solutions for remote reading of tachographs and driver cards, you can easily and automatically fulfil these requirements.

But did you know that you can also use this data from the legal requirements for numerous other purposes and directly realise additional benefits for your enterprise? This series of articles highlights selected use cases - all of which are included in TSI's range of services, of course!

Part 1: Data from driver cards: basis for working time and wage accounting

In this part we will look at how you can use the data from driver cards to do your drivers' working time and wage accounting - to the greatest extent automatically and without much extra effort.

Part 2: Data from driver cards: Automatic driver expenses accounting

Next time we will explain how journey, driving time and working time data serve as the basis for automatic driver expenses accounting, and how our unique Expenses AI virtually eliminates the effort for calculating expenses for you.

Driver card data: Basis for working time and wage accounting

Driver card data: Basis for working time and wage accounting

The requirement to use digital tachographs in conjunction with driver cards results from the EU Directive 2002/15/EC with the aim, so literally, „to improve the health and safety protection of persons performing mobile road transport activities and to improve road safety and align conditions of competition.to strengthen the protection of the safety and health of persons performing mobile road transport activities, to improve road safety and to bring about a greater harmonisation of conditions of competition.“

This translates into “specific provisions concerning the hours of work in road transport”, which include “rules on adequate rest, the maximum average working week, annual leave and certain basic provisions for night workers including health assessment.”

This translates into “specific provisions concerning the hours of work in road transport”, which include “rules on adequate rest, the maximum average working week, annual leave and certain basic provisions for night workers including health assessment.”

In order to enforce these minimum requirements, to control adherence, and, if necessary, to sanction violations, companies must record all activities of their driving personnel in detail by means of certified, tamper-proof tachographs – or, phrased differently, record working hours.

Is working time recording with tachographs sufficient?

It therefore would seem that the requirements for the deployment of tachographs represents a mandatory obligation for the recording of working times - which actually is exactly what the payroll department needs, is it not?

To a large extent yes, but not entirely! The legislator only monitors that working and driving times do not exceed maximum permissible durations and that breaks and rest periods are observed. The recording of holidays or sick leave, for example, is not taken into account in the tachographs at all. Consequently, the driver cards are not immediately sufficient for payroll accounting without further additions.

It is also far from unusual that some drivers occasionally do not take the recordings on the tachographs very seriously, that some supervisors do not check these very thoroughly, and that corrections and additions in the case of errors or missing data, which would be required by law, may not always be entered. As long as this does not compromise compliance with the legal driving, working and rest times as stipulated in the Driving Personnel Ordinance (German Only), for example, this often has only a secondary priority, especially as it only serves to fulfil control requirements. Yet when it comes to wages and salaries at the end of the month, all involved parties suddenly want to be absolutely precise!

It is also far from unusual that some drivers occasionally do not take the recordings on the tachographs very seriously, that some supervisors do not check these very thoroughly, and that corrections and additions in the case of errors or missing data, which would be required by law, may not always be entered. As long as this does not compromise compliance with the legal driving, working and rest times as stipulated in the Driving Personnel Ordinance (German Only), for example, this often has only a secondary priority, especially as it only serves to fulfil control requirements. Yet when it comes to wages and salaries at the end of the month, all involved parties suddenly want to be absolutely precise!

In summary, all data relevant to working times is recorded by tachographs and the associated driver cards, except for

- sick leave,

- absences and holidays,

- and in many cases, any additions and corrections.

In order to use the data from driver cards, some further actions and steps have to be added to the already available data. However, the overwhelming majority of the necessary working time recording is already accomplished.

TSI's intelligent working time manager completes driver card data into a comprehensive working time management and payroll accounting solution.

This is exactly where TSI's intelligent working time manager comes in, not only taking a lot of the burden off your drivers' payroll, but also eliminating the bulk of the work:

Intelligent Work Time Manager

Intelligent Work Time Manager

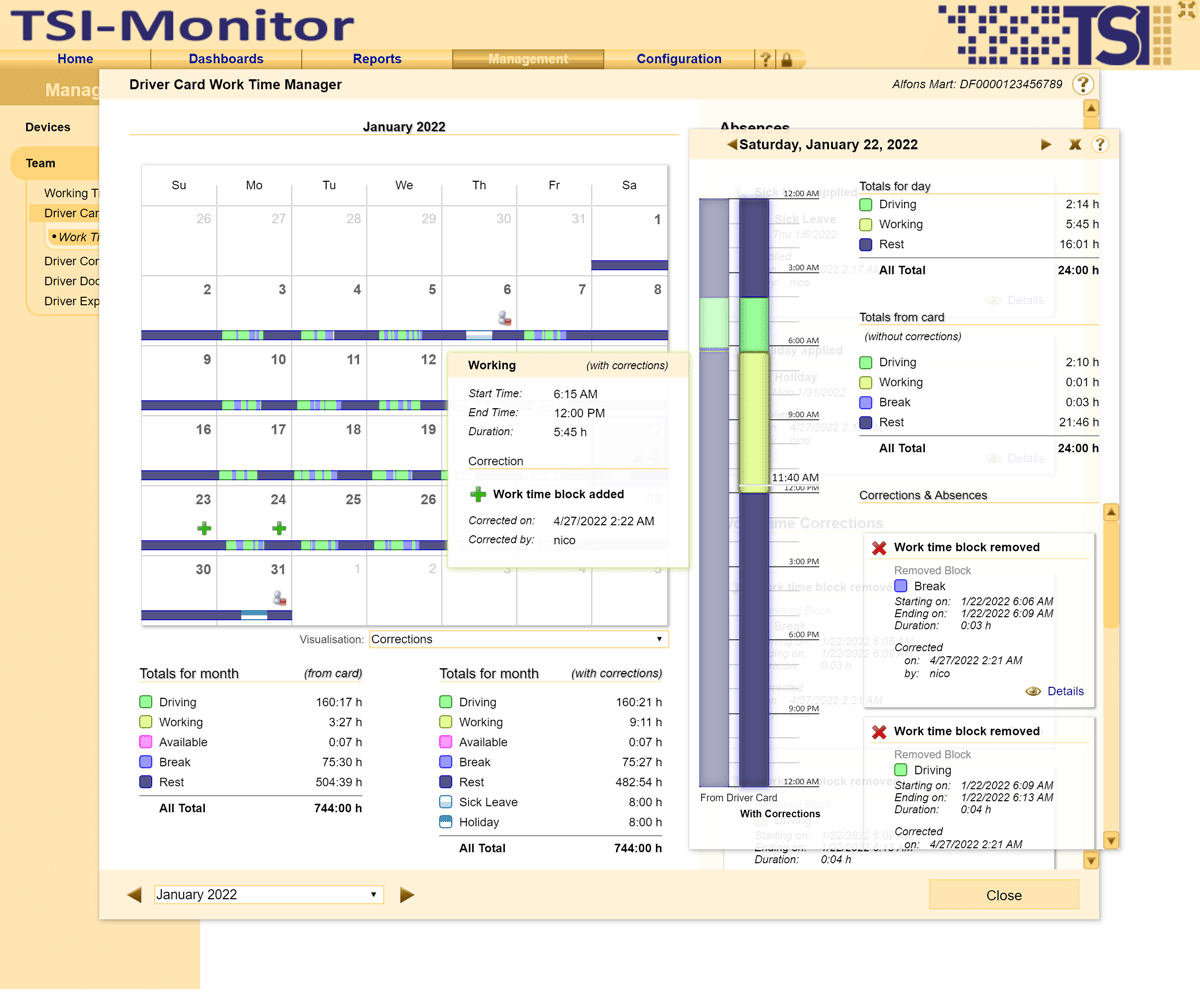

The intelligent working time manager offers a simple and clear visualisation of all data and enables central administration for all drivers.

Intuitive graphical guidance through the process, interactive feedback and instant visibility of all changes and daily and monthly totals, simplify everyday tasks.

Details regarding months, days, absences or illnesses are shown directly. A timeline indicates different types of work, rest or leave periods in detail.

.png) Entering corrections

Entering corrections

The addition of absences (even for longer periods), corrections, or the recording of holidays or sick leave are done directly in the manager. Zooming in on all available data makes the process efficient and easy.

Every entry and correction is recorded in a legally secure manner with timestamps and a record of the person responsible, thus meeting all requirements for verifiable payroll accounting at all times.

Interactive analyses

View all important data in special overviews. Whether weekly or daily reports, everything is flexible and customisable.

Totals for all working hours, including the consideration of individual night times or the highlighting of special cases are available to you in the application.

All columns are completely customisable, and a function for rounding is also already integrated.

Exporting to PDF, Excel or CSV for forwarding to your accounting department is also possible and easily customisable, just the way you need it.

Additional information

This is only a small selection of the many functions and possibilities that TSI customers can employ to unlock added value and secure significant competitive advantages. Find out more about the constantly growing range of services offered by TSI for the remote reading of digital tachographs and driver cards.

In the next part of this article series, we will explain how tachograph and driver card data can also be used in driver expenses accounting.

Deutsch

Deutsch