Most professional drivers of lorries and buses are legally obliged to use digital tachographs for all work-related journeys, which record driving times and breaks in detail.

Most professional drivers of lorries and buses are legally obliged to use digital tachographs for all work-related journeys, which record driving times and breaks in detail.

This serves not only to improve road safety, but also to protect social standards, the health of driving personnel and fair competitive conditions in the EU.

Companies that use drivers are therefore already subject to a number of obligations to regularly read out, archive and analyse this data.

Companies that use drivers are therefore already subject to a number of obligations to regularly read out, archive and analyse this data.

TSI has long been a leading provider of complete turnkey solutions for the remote reading of digital tachographs, permitting the fulfilment of these obligations not only remotely but also fully automatically.

Part 1: Data from driver cards: basis for working time and wage accounting

In the first part of this article series, we have explained the origins of these obligations and how these can be beneficially integrated for other purposes in the company, in particular work time accounting for drivers.

Part 2: Data from driver cards: Automatic driver expenses accounting

In this second part, we focus on a related topic, namely driver expenses: This primarily revolves around lump-sum payments for additional meal expenses, the so-called small or large meal allowances, but overnight accommodation allowances and other case-specific payments can also fall into this category, such as allowances for children day care.

Part 2: Data from driver cards: Automatic driver expenses accounting

Of course, the background to this is that employees who work considerable hours away from home or a fixed place of work incur additional costs for their own meals. The legislator allows a tax-free possibility to take these additional expenditures into account, either by employers reimbursing these costs or, alternatively, by employees being able to deduct these from their own income tax.

Of course, the background to this is that employees who work considerable hours away from home or a fixed place of work incur additional costs for their own meals. The legislator allows a tax-free possibility to take these additional expenditures into account, either by employers reimbursing these costs or, alternatively, by employees being able to deduct these from their own income tax.

Even though the payment of meal allowances is not obligatory for companies, it is quite common in the transport, logistics and bus industries and represents an important component in the wage structure for drivers. This is crucial for many companies in today's tight labour market for finding suitable driving personnel.

Correctly calculating expenses

Correctly calculating expenses

The calculation of applicable expenses and flat rates is not trivial and requires additional information. The data stored in the digital tachographs and in the driver cards, however, does not contain this information, or only to a limited extent.

According to the German Income Tax Act, for example, it is not the pure working time but the absence from the place of residence that is decisive for per diem meal allowances, which may include, for example, individual time for each driver to commute from his/her place of residence to the workplace.

Similarly, different flat rates apply depending on the country and region, which makes significant differences for long-distance drivers for international goods traffic and for long-distance bus tourism. On top of this, it is also the place that is last reached before midnight that is relevant in the case of overnight driving.

TSI's Expenses AI

TSI, as a specialist for telematics data and its processing, has developed and implemented a unique, state-of-the-art artificial intelligence (AI) system, which aggregates a wide variety of data sources, evaluates their respective quality on a case-by-case basis and uses this data to determine correct flat-rate expense allowances for each working day.

TSI, as a specialist for telematics data and its processing, has developed and implemented a unique, state-of-the-art artificial intelligence (AI) system, which aggregates a wide variety of data sources, evaluates their respective quality on a case-by-case basis and uses this data to determine correct flat-rate expense allowances for each working day.

In doing so, we have not only ensured compliance with data protection requirements and the General Data Protection Regulation (GDPR), but have also firmly anchored fundamental ethical principles in the core of the AI, so that every decision made by the Expenses AI is fully transparent and explainable at all times. As such, it is one of the fundamental basic and human rights, which daily gains more relevance for the 21st century, and for which TSI actively advocates. This also includes the revisability of every single result of the AI, ensuring that it is always a human who remains the final authority in every decision, without exception.

Some of the aspects of this approach are already required by the GDPR, even though not mandatory for this type of application. Others will probably not be regulated until the European AI law at the earliest, as the official draft of 21.4.2021 allows us to hope. In any case, TSI is not only already a pioneer in the use of the latest AI technologies, but also adopts responsibility for the safe, fair, and ethically valuable use of these technical possibilities starting already in the design stage.

Some of the aspects of this approach are already required by the GDPR, even though not mandatory for this type of application. Others will probably not be regulated until the European AI law at the earliest, as the official draft of 21.4.2021 allows us to hope. In any case, TSI is not only already a pioneer in the use of the latest AI technologies, but also adopts responsibility for the safe, fair, and ethically valuable use of these technical possibilities starting already in the design stage.

What does TSI's Expenses AI provide?

TSI's Expenses AI automatically recognises per diems for small and large meals expenses based on working time data from driver cards, but also takes into account other details about each individual driver, such as distances to their homes and commuting times. The AI also takes into account the journey destinations and locations, some of which may already be available when using new smart tachographs, but some of which have to be obtained from additional sources, such as location tracking data recorded automatically by means of the vehicle on-board units. This means that country- and region-specific flat rates can also be accurately identified.

TSI's Expenses AI automatically recognises per diems for small and large meals expenses based on working time data from driver cards, but also takes into account other details about each individual driver, such as distances to their homes and commuting times. The AI also takes into account the journey destinations and locations, some of which may already be available when using new smart tachographs, but some of which have to be obtained from additional sources, such as location tracking data recorded automatically by means of the vehicle on-board units. This means that country- and region-specific flat rates can also be accurately identified.

In addition, the Expenses AI identifies days on which an overnight allowance is applicable, e.g. when drivers sleep in their vehicles.

All of this is provided completely functional out-of-the-box, without the need for a complex initial set-up. Yet, as is usual with TSI, all aspects of the expenses accounting are still fully customisable, ranging from individual allowances or cases where companies grant the legally possible 200% of the expenses or even supplementary and company-specific per diems and expenses agreements, such as per diems for childcare and similar.

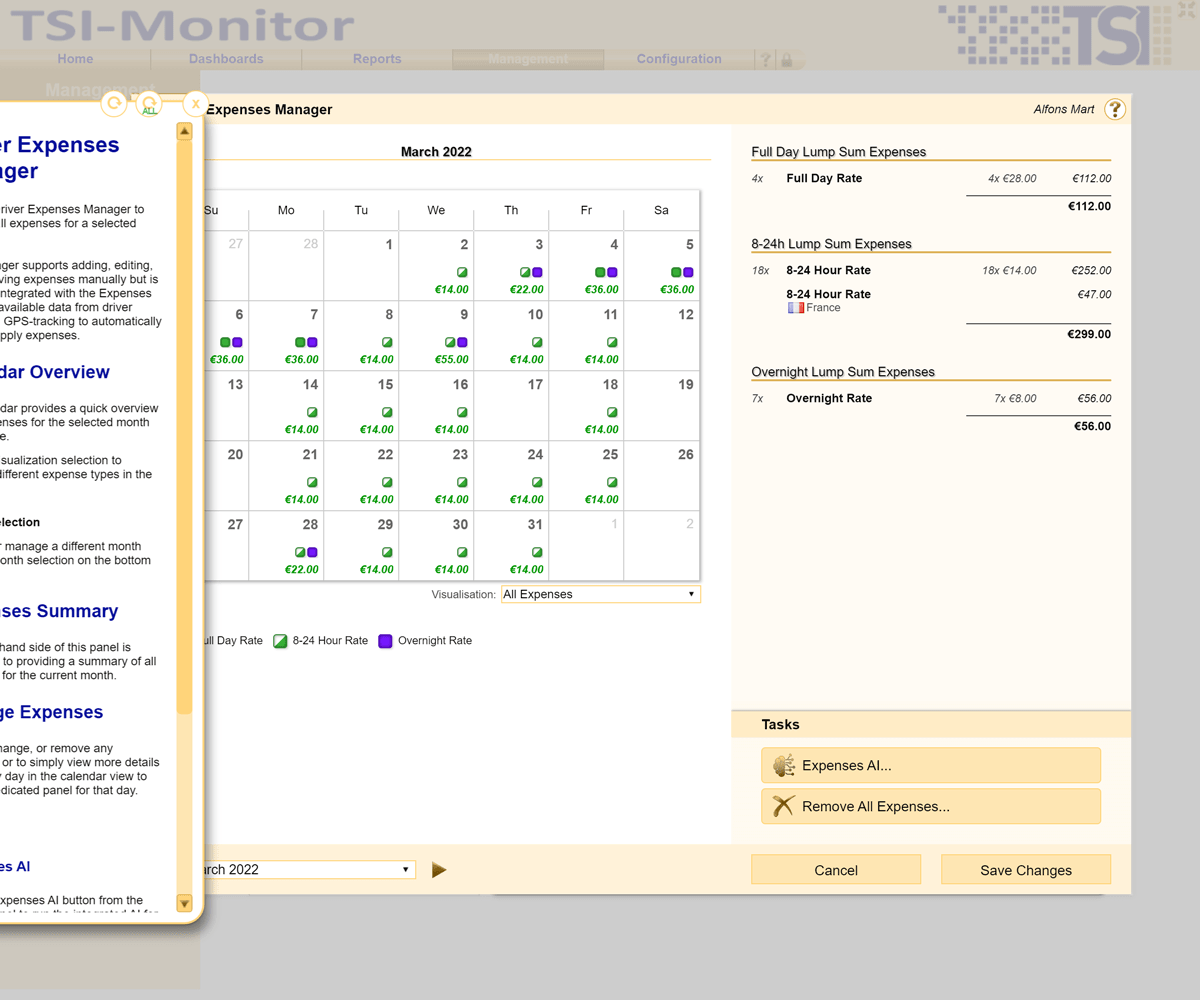

Driver Expenses Management with TSI

The expenses management for your drivers in TSI's system allows for convenient insight and control of all aspects of your meals, accommodation and other per diems in one central location..

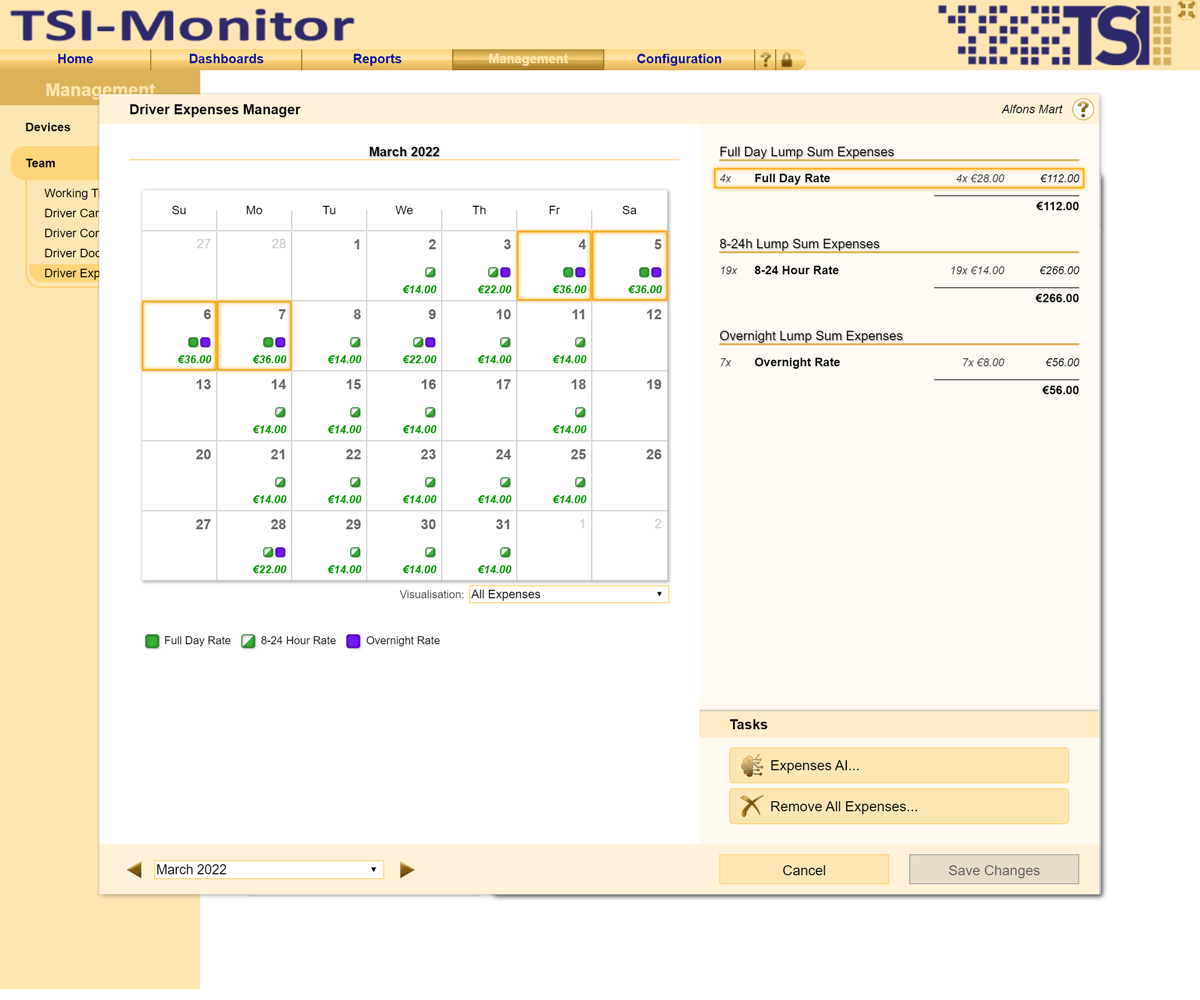

Central management of all driver expenses

Central management of all driver expenses

The Driver Expenses Manager ensures easy administration and offers various interactive visualisation options. All expenses are broken down by day, with applicable expense rates.

Automatic calculation of:

- Small & large meal per diems

- Overnight accommodation flat rate

- Country and region-specific expense rates

- Individual flat rates & supplementary allowances

All expenses & per diems at a glance

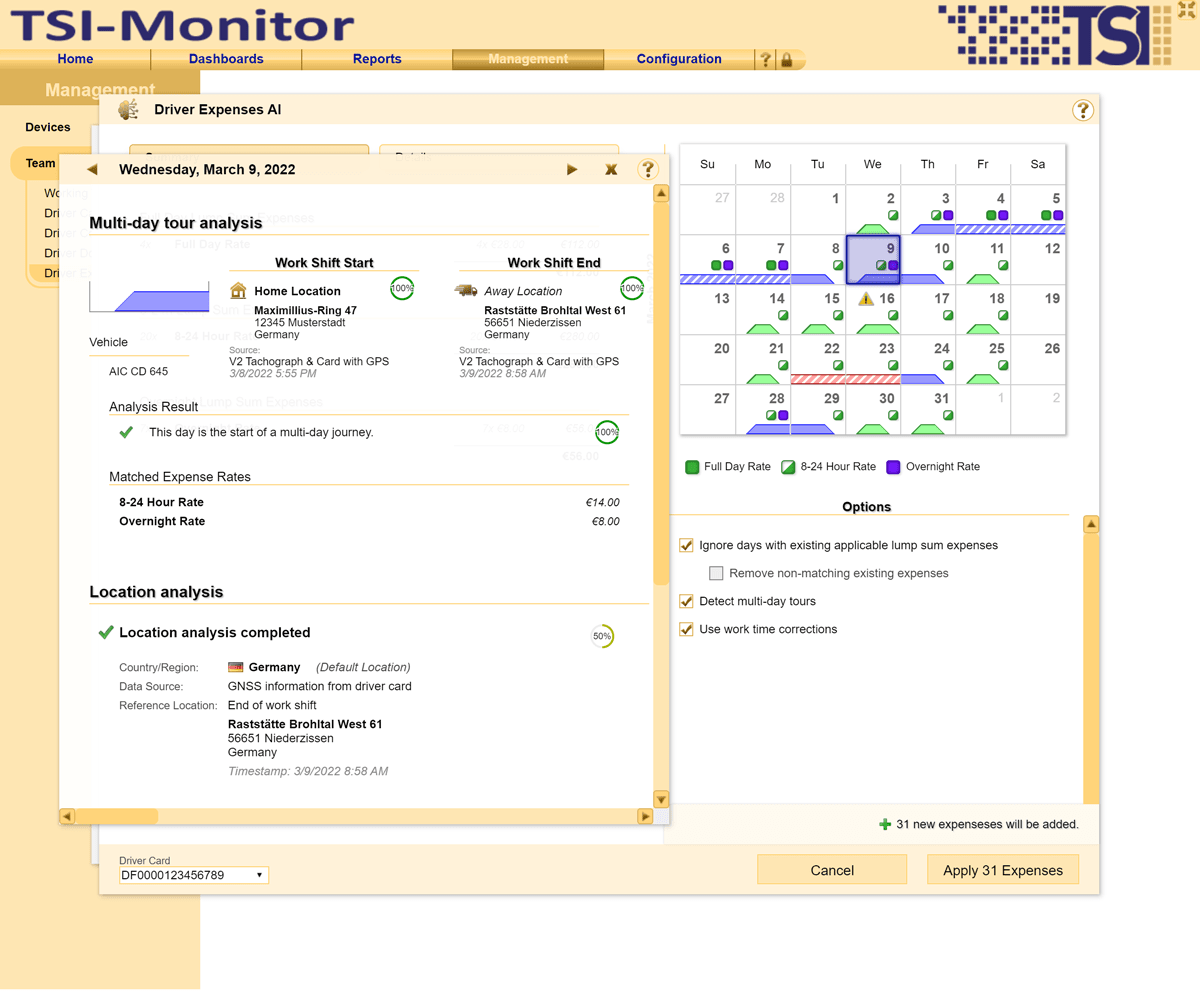

Expenses AI

Expenses AI

The unique Expenses AI automatically detects and combines available driver-related data for the analysis of multi-day tours from:

- Driver cards

- Digital & smart tachographs (vehicle data)

- Working time management

- GPS tracking/location data

- Individual commutes

- Country and region-specific expense rates

and determines relevant expense rates for each day.

TSI Expenses AI — Expenses & meal per diems with 1 click!

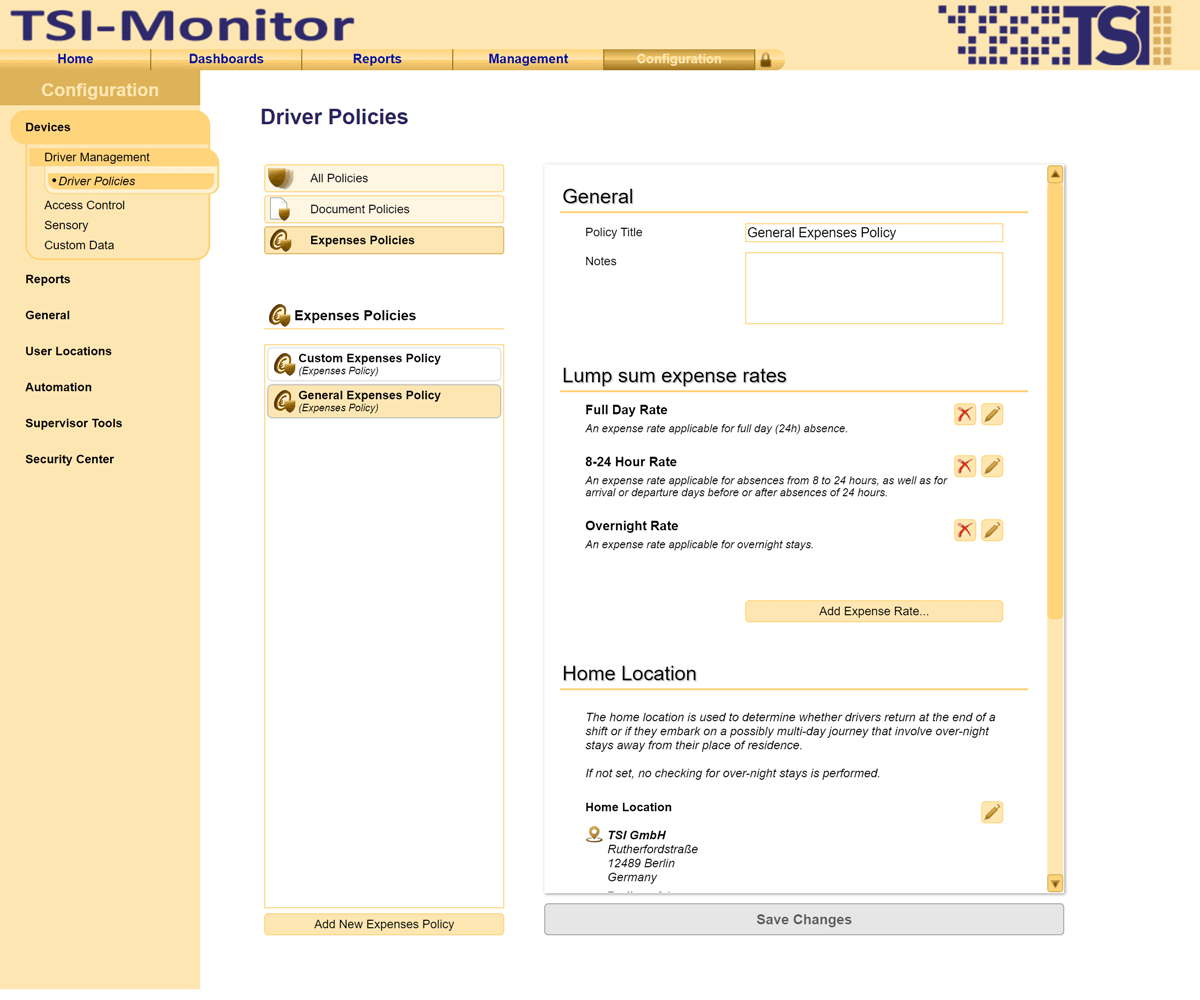

Expense Rate Policies

Expense Rate Policies

Customised and company-specific expenses, expense rates and adjustments are of course also possible.

Define individual bonuses for your drivers on top of standard rates or adjust relevant commuting times to take account of absences from places of residence rather than place of work.

Tailor-made and specific to your company: Customisable for your requirements!

Intelligent online help

Intelligent online help

Our interactive online help supports you in all daily tasks and helps you with any questions that may arise.

The help is context-sensitive and always shows the right topic for the current task.

More information

We are constantly adding and expanding the range of functions of our solutions and are proud to be able to draw on the constructive feedback and suggestions from our many customers. Hence, our products are not only always at the cutting edge of what is technically possible, but also deliver real added value for our users.

Find out more about our comprehensive solutions for remote reading of digital tachographs or our numerous other industry-leading telematics offerings and don't hesitate to call on our experienced digitisation experts - contact us now!

Deutsch

Deutsch